pay my past due excise tax massachusetts

Web Your browser appears to have cookies disabled. Web How do I pay my excise tax in Randolph MA.

Fuel Taxes In The United States Wikipedia

IF YOUR LICENSE IS SUSPENDED YOU MUST PAY WITH CASH OR MONEY ORDER Please use.

. All information provided on an excise. Nonpayment of a bill triggers a demand bill to be. Web Pay Past Due Excise Tax Bills.

Please note all online payments will have a 45 processing fee added to your total due. A person who does not receive a bill is still. Cookies are required to use this site.

If you are unable to find your bill try searching by bill type. Find your bill using your license number and date of birth. Drivers License Number Do not enter vehicle plate.

Web How do I pay for overdue excise taxes that have been marked at the Registry of Motor Vehicles for non-renewal. Payment of the motor vehicle excise is due 30 days from the date the excise bill is issued not mailed. This information will lead you to The.

Web PAY YOUR BILL ON TIME. Residents can view and pay their tax and utility bills online with Citizen Self Service. Web According to MGL excise bills must be mailed out 30 days before the due date thus providing 30 days for the principal balance to be paid.

Web All owners of motor vehicles must pay an excise tax. Web If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill. Web Tax And Utility Bills.

Web Massachusetts Motor Vehicle Excise Tax Information. Web All vehicles in the State of Massachusetts are subject to an annual motor vehicle excise tax. All information provided on an excise tax bill comes directly from the Registry of Motor.

Web Motor Vehicle Excise Tax bills are due in 30 days. Payment at this point must be made through our Deputy. Click on Motor Vehicle Excise Tax if you want further information concerning Excise Tax.

Web Pay my past due excise tax. If you dont make your payment within 30 days of the date the City issued the excise tax interest and fees are added to your bill. Web Excise tax payments are due 30 days from the original date of the bill after which a demand bill will be sent out with interest and penalty.

Therefore it is the responsibility of the owner to contact the local assessor if heshe has not received a bill. Before making any tax or utility bill payments please see Online Payments. Bills that are more than 45 days past.

The tax will be delivered to the. Web Online Payment Search Form. If the bill goes unpaid interest accrues at 12 per annum.

Excise tax demand bills are. We strongly encourage you to pay your Excise tax bills online or by dropping the check and bill in the outside dropbox. THIS FEE IS NON-REFUNDABLE.

How To Pay Your Motor Vehicle Excise Tax Boston Gov

Look Up Pay Bills Town Of Arlington

Pay Your Bills Online Winthropma

Massachusetts Marijuana Excise Tax Revenue Exceeds Alcohol For First Time

Motor Vehicle Excise Tax Bills Gardner Ma

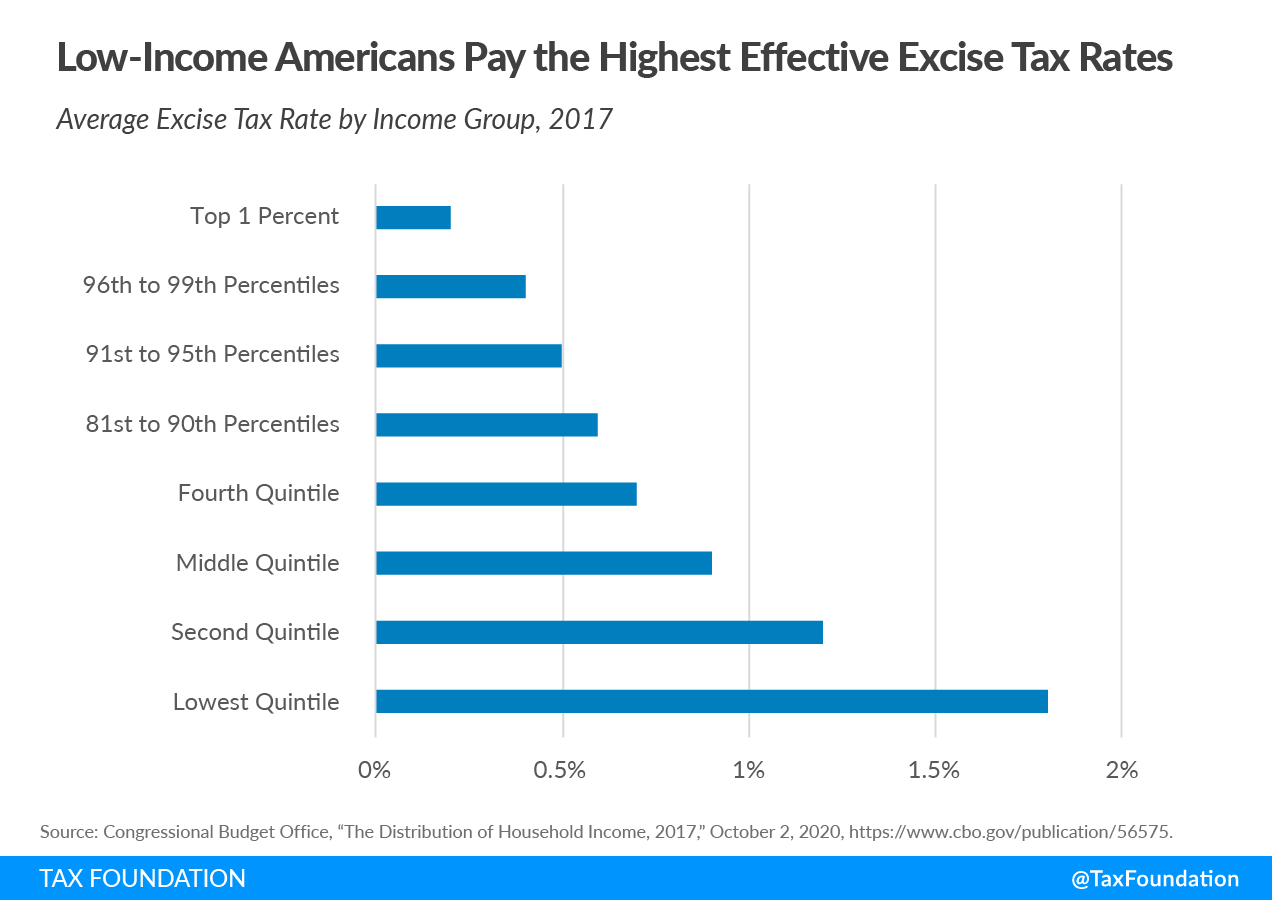

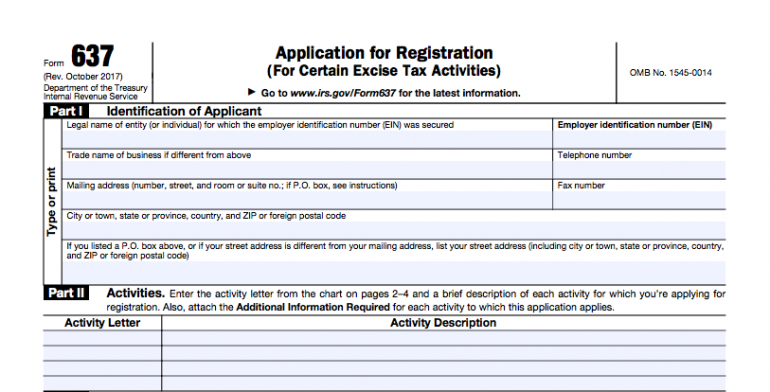

Excise Taxes Excise Tax Trends Tax Foundation

2021 Motor Vehicle Excise Tax Bills Fairhavenma

Excise Tax The Ultimate Guide For Small Businesses Nerdwallet

Dor Tax Due Dates And Extensions Mass Gov

Did You Know Motor Vehicle Excise Tax

Excise Tax Information Templeton Ma Official Government Website

Did You Know Motor Vehicle Excise Tax

Do You Report Paid Excise Tax In Massachusetts

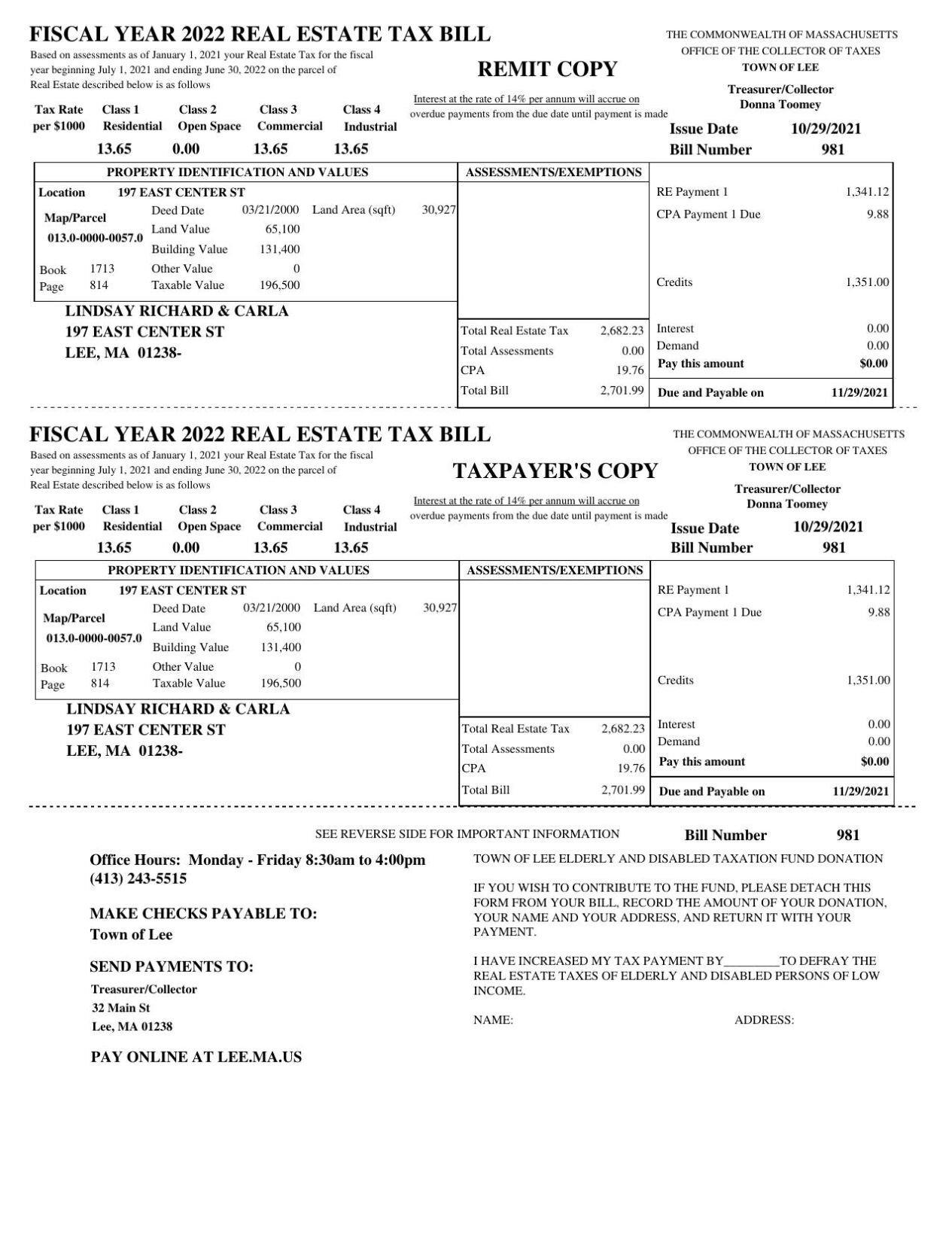

6 Things To Know About Your Property Tax Bill If You Own A Home In Berkshire County Local News Berkshireeagle Com